This workshop is a sequence of five parts, divided into Session One and Session Two. Session One (Parts A and B) covers Micro Farm eligibility requirements and the application process. In Session Two (Parts C, D, and E), we’ll look at ways to refine your financial recordkeeping. We invite you to attend one or both sessions depending on your interests and needs.

Session 1: Micro Farm Insurance – What is This and Who is Eligible?(Part A) Leave knowing whether Micro Farm insurance is applicable to your operation and what other risk management options are available if you are currently ineligible.

Session 1: Micro Farm Insurance – Applying for Insurance and What You Need to Know(Part B) Leave knowing how to apply for and benefit from Micro Farm insurance, and what financial records you will need. Understand how the insurance premium and coverage works, and how to work with an insurance agent and place a claim.

Session 2: Refining Your RecordsRefine your financial recordkeeping to better manage your farm business and prepare you for the Micro Farm insurance program. (Part C) Understanding Your Farm’s Financial Records (Part D) Preparing a Schedule F Tax Form (Part E) Steps for Improving Your Financial Recordkeeping

Can’t attend but still could use the help? Check out these self-guided tools:

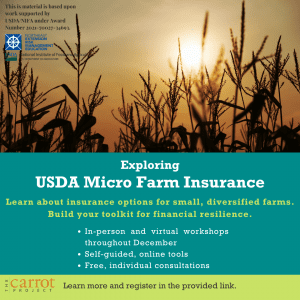

Check out The Carrot Project’s resources on USDA Micro Farm insurance and register for workshops here: https://thecarrotproject.salsalabs.org/microfarmworkshop20222023